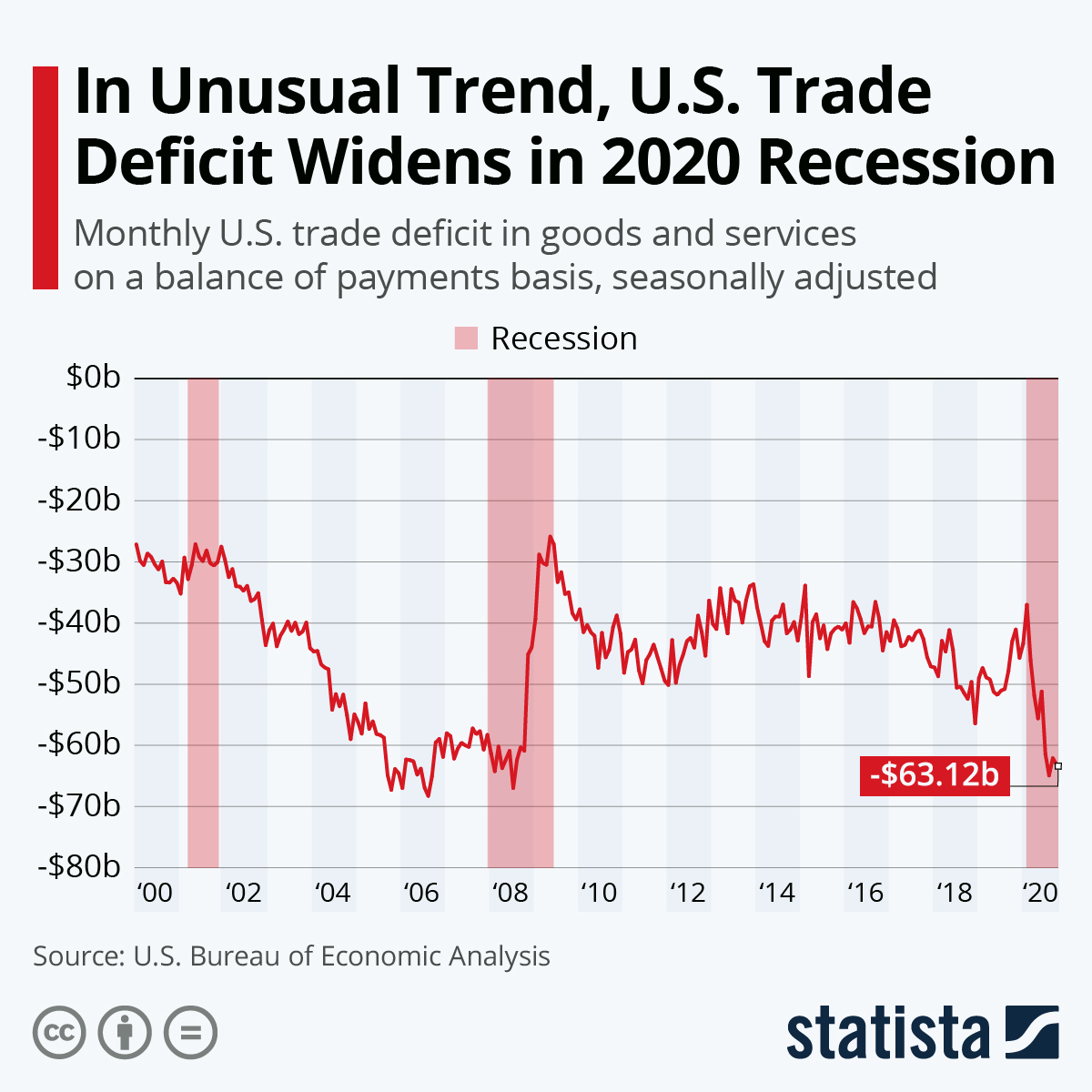

The United States has been running a trade deficit for many years. In 2022, the trade deficit was $859 billion. This is a major problem for the US economy, as it leads to a number of negative consequences.

One of the biggest problems with a trade deficit is that it leads to a loss of jobs in the export sector. When the US imports more goods and services than it exports, it means that there is less demand for US-made goods and services. This leads to job losses in the manufacturing, agriculture, and service sectors.

A trade deficit can also lead to a decline in the value of the currency. This is because a trade deficit means that there is more demand for foreign currencies than there is for US dollars. This drives up the value of foreign currencies and makes US exports more expensive.

A trade deficit can also lead to a trade war. When one country runs a trade deficit with another country, the deficit country may impose tariffs on imports from the surplus country. This can lead to a trade war, which can damage the economies of both countries.

|

| Trade Imbalances |

The stability of the reserve currency is also affected by trade imbalances. The US dollar is the world's reserve currency, which means that it is the currency that is most widely used in international trade and finance. The dollar's status as a reserve currency gives it a number of advantages, including:

- It makes it easier for the US to borrow money from foreign investors.

- It makes the US dollar a more attractive currency for investors to hold.

- It gives the US more influence over the global economy.

If the US continues to run a trade deficit, it could lead to the collapse of the dollar's status as a reserve currency. This would have a number of negative consequences for the US economy, including:

- It would make it more difficult for the US to borrow money from foreign investors.

- It would make the US dollar a less attractive currency for investors to hold.

- It would give the US less influence over the global economy.

The US government needs to take steps to reduce the trade deficit. This could be done by:

- Increasing exports.

- Reducing imports.

- Renegotiating trade deals.

- Investing in education and training to create jobs in the export sector.

- Maintaining a strong economy.

- Keeping interest rates low.

- Reducing the national debt.

In addition to the economic consequences, trade imbalances can also have a number of political consequences. For example, a trade deficit can lead to resentment and anger among the public, which can make it more difficult for the government to pass trade agreements. Trade imbalances can also lead to tensions between countries, which can increase the risk of conflict.

The issue of trade imbalances is complex and there is no easy solution. However, it is clear that trade imbalances can have a number of negative consequences for both the economy and the political stability of the countries involved.

Research Resources and Information

|

| Research Resources and Information |

These are just a few resources for you to start doing your own research on the impact of global economic shifts and changing power dynamics on reserve currencies. The topic is complex and there is no easy answer, but these research resources provide some insights into the challenges and opportunities that lie ahead.

The Importance of Doing Your Own Research

In today's world, it is more important than ever to be able to assess the accuracy, truth, and long-lasting effect of data, assertions, information, or concepts. With so much information available at our fingertips, it can be difficult to know where to start or how to determine what is accurate. That's why it's so important to do your own research.

There are a few key things to keep in mind when doing your own research:

- Start with a clear question or hypothesis. What do you want to know? What are you trying to prove or disprove? Having a clear question or hypothesis will help you focus your research and avoid getting sidetracked.

- Find reputable sources. Not all sources are created equal. When you're doing research, it's important to find sources that are reputable and credible. Look for sources that are from reliable organizations, such as universities, government agencies, or well-respected news organizations.

- Evaluate the sources critically. Just because a source is reputable doesn't mean that everything it says is true. It's important to evaluate the sources critically and look for evidence to support their claims. Ask yourself questions like: Who wrote the source? What is their expertise? What are their biases?

- Be aware of your own biases. Everyone has biases, so it's important to be aware of your own when you're doing research. Try to be objective and look at the evidence from all sides.

- Use multiple sources. Don't rely on just one source when you're doing research. Look for multiple sources that support the same claim. This will help you to get a more complete picture of the issue.

In addition to the above, here are some other tips for doing your own research:

- Use search engines wisely. When you're searching for information, use specific keywords and phrases. This will help you to narrow down your results and find more relevant information.

- Use social media to your advantage. Social media can be a great way to find and share information. Follow reputable organizations and individuals who share information that you're interested in.

- Don't be afraid to ask for help. If you're stuck or confused, don't be afraid to ask for help from a librarian, teacher, or other trusted individual.

- By following these tips, you can become a more informed and critical thinker. You'll be better equipped to assess the accuracy, truth, and long-lasting effect of data, assertions, information, or concepts.

|

| Quotes |

Quotes

- "Trade imbalances can be a problem for reserve currencies, as they can lead to concerns about the sustainability of the currency's value." - Barry Eichengreen, Professor of Economics, University of California, Berkeley

- "If a country runs a large trade deficit, it will need to borrow money from other countries to finance that deficit. This can lead to a buildup of debt, which can make the currency less stable." - Eswar Prasad, Professor of Economics, Cornell University

- "Trade imbalances can also lead to a loss of confidence in the currency, as investors may worry that the country will not be able to repay its debts. This can lead to a decline in the value of the currency, which can further exacerbate the trade imbalance." - Michael Feroli, Chief Economist, JPMorgan Chase

- "The stability of the reserve currency is important for the global economy, as it provides a safe haven for investors and helps to facilitate trade. However, trade imbalances can pose a threat to the stability of the reserve currency, and it is important to address these imbalances in order to maintain the stability of the global financial system." - Mohamed El-Erian, Chief Economic Adviser, Allianz

These quotes highlight the importance of trade imbalances and the stability of the reserve currency. The reserve currency status of a currency is a complex issue, and there is no single factor that is most important. However, trade imbalances can pose a significant threat to the stability of the reserve currency, and it is important to address these imbalances in order to maintain the stability of the global financial system.

|

| Experts |

Experts

- Barry Eichengreen is a professor of economics at the University of California, Berkeley, and a former economic advisor to the International Monetary Fund. He is the author of several books on the history of money and international finance, including The European Economy Since 1945 and Globalizing Capital: A History of the International Monetary System.

- Eswar Prasad is a professor of economics at Cornell University and a former chief economist at the International Monetary Fund. He is the author of several books on the global economy, including The Dollar Trap: How the U.S. Dollar Undermines Global Prosperity and The Future of the Dollar: The Politics of International Money.

- Michael Feroli is the chief economist at JPMorgan Chase. He is a frequent commentator on the global economy and has written extensively on the role of the dollar in the global financial system.

- Mohamed El-Erian is the chief economic adviser at Allianz. He is a former managing director of Pimco and chairman of the economic council to the President of the United States. He is the author of several books on the global economy, including The Only Game in Town: Central Banks, Instability, and Avoiding the Next Financial Crisis and When Markets Collide: Investment Strategies for the Age of Global Economic Turbulence.

- Paul Krugman is a Nobel Laureate in Economics and a professor at the Graduate Center of the City University of New York. He is a frequent commentator on the global economy and has written extensively on the role of the dollar in the global financial system.

These are just a few of the many experts who have written on the topic of trade imbalances and the stability of the reserve currency.

|

| Case Studies |

Case Studies

- The US trade deficit: The US has run a trade deficit for most of the past few decades. This has led to a buildup of foreign debt, which has raised concerns about the sustainability of the dollar's value.

- The Chinese trade surplus: China has run a trade surplus for most of the past few decades. This has led to concerns about the sustainability of the renminbi's value, as well as the impact of the surplus on the global economy.

- The Japanese trade surplus: Japan ran a trade surplus for most of the 1980s and 1990s. This led to concerns about the sustainability of the yen's value, as well as the impact of the surplus on the global economy.

- The eurozone trade imbalances: The eurozone has experienced a number of trade imbalances in recent years. This has led to concerns about the sustainability of the euro's value, as well as the impact of the imbalances on the global economy.

These are just a few of the many case studies that can be used to understand the role of trade imbalances in the stability of the reserve currency. By studying these case studies, we can gain a better understanding of the complex factors that influence the stability of the reserve currency.

It is important to note that trade imbalances are not the only factor that can affect the stability of the reserve currency. Other factors, such as inflation, interest rates, and fiscal policies, can also play a role. However, trade imbalances can be a significant factor, and it is important to address them in order to maintain the stability of the reserve currency.

|

| Books |

Books

- The Dollar Trap: How the U.S. Dollar Undermines Global Prosperity by Eswar Prasad

- The Future of the Dollar: The Politics of International Money by Barry Eichengreen

- The End of the Dollar Empire: How the U.S. Must Change Before It Can Dominate Again by Martin Wolf

- The Reserve Currency: Why the Dollar Still Rules by Benn Steil

- The Euro: How a Common Currency Brought Europe Together and Why It Threatens to Tear It Apart by Timothy Garton Ash

- The Rise of the Renminbi: Can China's Currency Challenge the Dollar? by Nicholas Lardy

- The Global Monetary System: Past, Present, and Future by Barry Eichengreen and Michael Mussa

- The International Monetary System: History, Theory, and Reform by Charles Kindleberger and Robert Aliber

These books provide a comprehensive overview of the factors that influence trade imbalances and the stability of the reserve currency. They discuss the history of trade imbalances, the challenges facing the dollar today, and the potential for other currencies to challenge the dollar's dominance in the future.

In addition to these books, there are a number of other resources available on this topic. These include academic journals, news articles, and websites.

The stability of the reserve currency is a complex issue, and there is no single book that provides all the answers. However, the books listed above provide a valuable starting point for understanding the factors that influence trade imbalances and the stability of the reserve currency.

|

| Articles |

Articles

- The Future of the Dollar: Will the Greenback Remain the World's Reserve Currency? by The Economist

- The Dollar's Reserve Currency Status: Is It in Jeopardy? by The Brookings Institution

- The Rise of the Renminbi: Can China's Currency Challenge the Dollar? by The Wall Street Journal

- The Euro as a Reserve Currency: Is It a Threat to the Dollar? by The Financial Times

- The End of the Dollar Empire: How the U.S. Must Change Before It Can Dominate Again by Martin Wolf

- The Reserve Currency: Why the Dollar Still Rules by Benn Steil

- Trade Imbalances and the Stability of the Reserve Currency by Barry Eichengreen

- The Impact of Trade Imbalances on the Global Economy by Eswar Prasad

- Can China's Renminbi Challenge the Dollar as the World's Reserve Currency? by Nicholas Lardy

These articles provide a more in-depth look at the factors that influence trade imbalances and the stability of the reserve currency. They discuss the history of trade imbalances, the challenges facing the dollar today, and the potential for other currencies to challenge the dollar's dominance in the future.

In addition to these articles, there are a number of other resources available on this topic. These include academic journals, news articles, and websites.

The stability of the reserve currency is a complex issue, and there is no single article that provides all the answers. However, the articles listed above provide a valuable starting point for understanding the factors that influence trade imbalances and the stability of the reserve currency.

Comments

Post a Comment

Thank you for your comments and ideas.