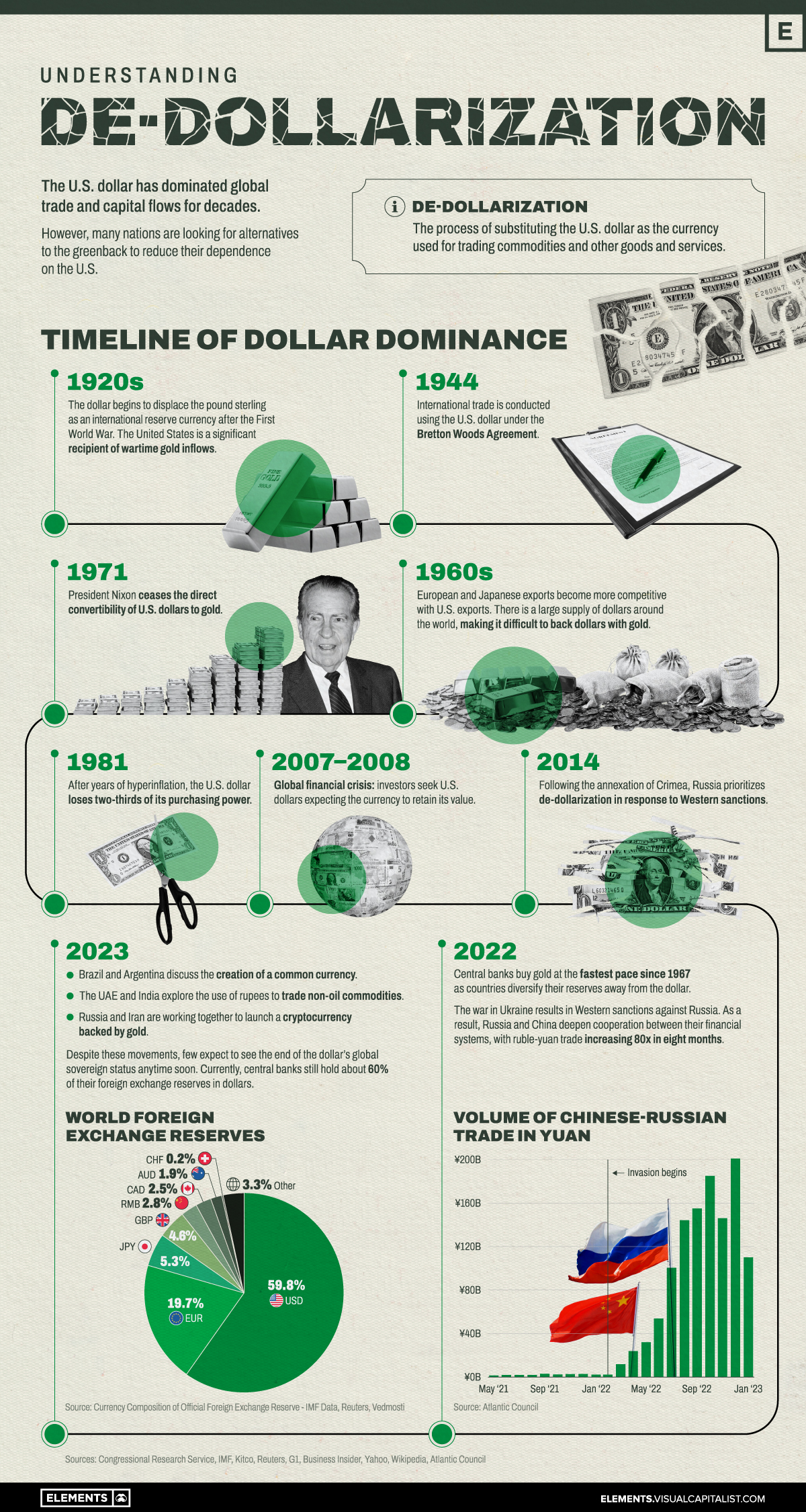

The US dollar has been the world's reserve currency for over 70 years. However, in recent years, there has been growing calls for a new reserve currency. This is due to a number of factors, including the US's growing debt, its trade deficit, and its political instability.

There are a number of potential alternative reserve currencies. These include the euro, the Chinese renminbi, the Japanese yen, and the British pound.

The euro is the most likely candidate to replace the US dollar as the world's reserve currency. The euro is backed by a strong economy and a stable political system. The euro is also the second most traded currency in the world.

The Chinese renminbi is another potential candidate to replace the US dollar as the world's reserve currency. The Chinese economy is growing rapidly, and the Chinese government is taking steps to make the renminbi more convertible. However, the renminbi is still not as freely traded as the euro or the US dollar.

The Japanese yen is a stable currency, but the Japanese economy is stagnant. The British pound is a strong currency, but the UK economy is small and its political system is unstable.

In addition to these traditional currencies, there are a number of new potential reserve currencies. These include cryptocurrencies, such as Bitcoin, and digital currencies, such as central bank digital currencies (CBDCs).

Cryptocurrencies are decentralized and not subject to government control. This makes them attractive to countries that are looking to reduce their reliance on the US dollar. However, cryptocurrencies are volatile and not widely accepted.

CBDCs are digital versions of fiat currencies. They are issued by central banks and are backed by the full faith and credit of the issuing government. CBDCs are still in the early stages of development, but they have the potential to become a major player in the global financial system.

The future of the global reserve currency is uncertain. The US dollar is still the dominant currency, but its dominance is waning. The euro, the Chinese renminbi, and other currencies are vying for the top spot. Cryptocurrencies and CBDCs are also emerging as potential challengers.

The market and geopolitical conditions are constantly changing. This makes it difficult to predict which currency will emerge as the next global reserve currency. However, it is clear that the US dollar's dominance is coming to an end. The world is looking for a new reserve currency, and a number of currencies are vying for the top spot.

Here are some of the factors that will likely determine which currency becomes the next global reserve currency:

- Stability: The currency must be stable and not subject to wild fluctuations in value.

- Liquidity: The currency must be freely traded and easily accessible.

- Acceptance: The currency must be widely accepted by businesses and governments around the world.

- Credibility: The currency must be backed by a strong economy and a stable political system.

The currency that best meets these criteria is likely to emerge as the next global reserve currency.

References and Resources

- Articles

- The Case for a New Reserve Currency by Eswar Prasad, published in Foreign Affairs, March/April 2016.

- The Rise of the Yuan as a Reserve Currency by Eswar Prasad, published in The Atlantic, January 2015.

- The Future of the Reserve Currency by Barry Eichengreen, published in The Journal of Economic Perspectives, Summer 2011.

- Books

- The Reserve Currency Trap: The Future of the Dollar and the Role of China by Eswar Prasad, published by Princeton University Press, 2014.

- The End of the Dollar Dynasty: How the Rise of China Challenges the Global Financial System by Martin Wolf, published by Yale University Press, 2014.

- The Future of the International Monetary System by Barry Eichengreen, published by Oxford University Press, 2012.

- Websites

- International Monetary Fund (IMF): The IMF website has a section on the international monetary system, including information on reserve currencies.

- Bank for International Settlements (BIS): The BIS website has a section on reserve currencies, including research on the topic.

- World Economic Forum: The World Economic Forum website has a section on the future of the global economy, including information on the role of reserve currencies.

These are just a few references and resources that you may find helpful. If you are interested in learning more about alternative reserve currencies, I encourage you to explore these resources and others.

Comments

Post a Comment

Thank you for your comments and ideas.