:max_bytes(150000):strip_icc()/GettyImages-480922636-b14be4a73a594bad8f75adf132a77818.jpg)

Reserve Currencies

Reserve Currency Defined

:max_bytes(150000):strip_icc()/GettyImages-480922636-b14be4a73a594bad8f75adf132a77818.jpg)

The Importance of a Reserve Currency

There are a number of reasons why having a reserve currency is important. First, it can help to promote economic stability. When a country's currency is widely used, it is less likely to experience sudden changes in value, which can help to protect businesses and consumers from economic shocks. Second, a reserve currency can make it easier for a country to borrow money. When central banks and other financial institutions hold a country's currency, they are more likely to lend money to that country, which can help to finance government spending and investment. Third, a reserve currency can give a country more influence in the global economy. When a country's currency is used for international transactions, it gives that country a greater say in how the global economy is managed.

The Benefits of a Reserve Currency

There are a number of benefits to having a reserve currency. First, it can help to reduce exchange rate risk. When a country's currency is widely used, it is less likely to experience sudden changes in value, which can help to protect businesses and consumers from economic shocks. Second, a reserve currency can make it easier for a country to borrow money. When central banks and other financial institutions hold a country's currency, they are more likely to lend money to that country, which can help to finance government spending and investment. Third, a reserve currency can give a country more influence in the global economy. When a country's currency is used for international transactions, it gives that country a greater say in how the global economy is managed.

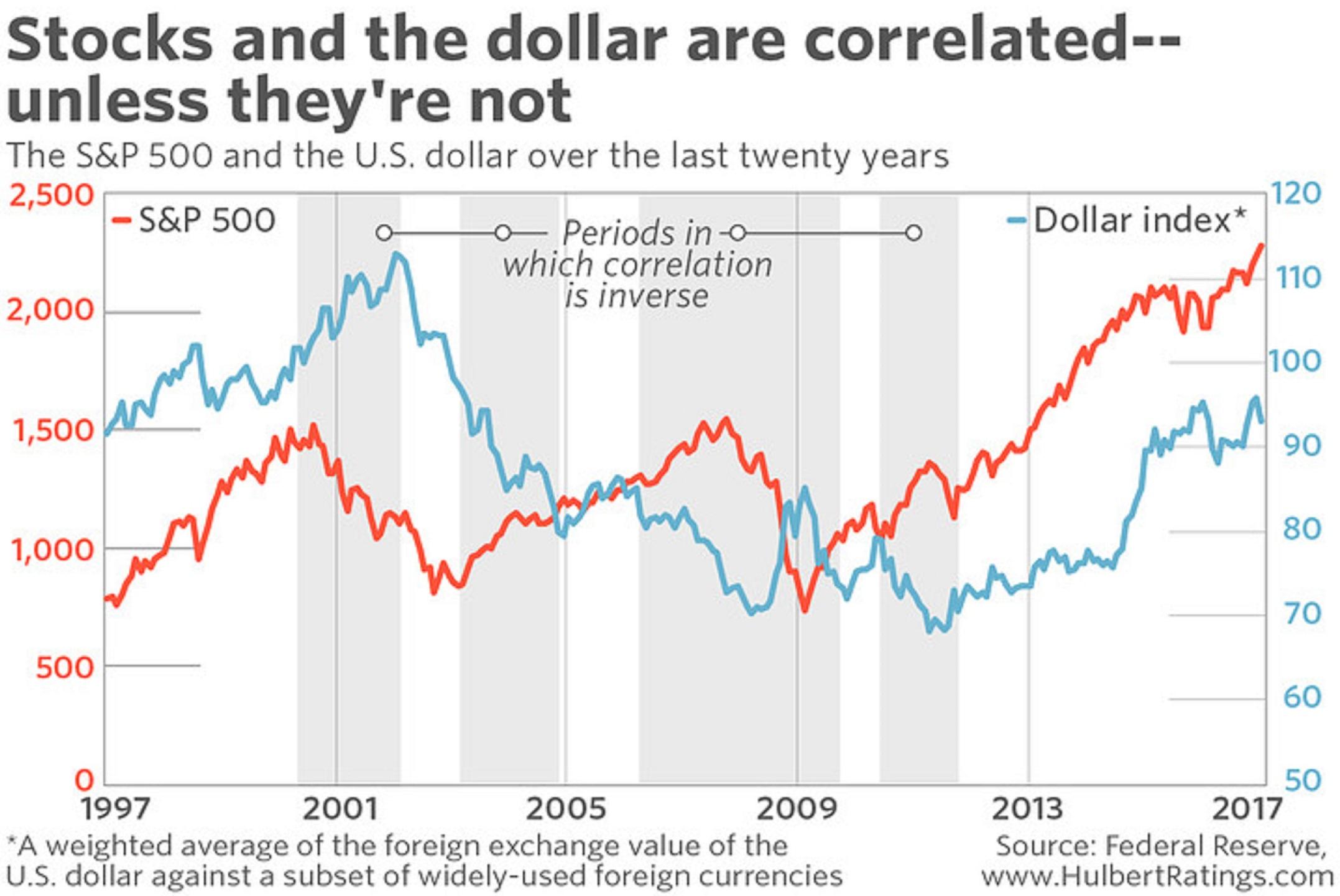

Image Credit: https://seekingalpha.com/article/4140994-u-s-dollar-index-contradictory-view-major-inflection-point

Challenges of a Reserve Currency

There are also a number of challenges to having a reserve currency. First, it can make a country vulnerable to economic shocks. When a country's currency is widely used, it is more likely to be affected by economic shocks in other countries. For example, if there is a financial crisis in another country, it could lead to a decline in the value of the reserve currency, which could hurt the economies of countries that hold that currency. Second, a reserve currency can make a country's monetary policy more difficult. When a country's currency is used for international transactions, it is more difficult for the central bank to control the value of the currency. This is because the central bank has to take into account the needs of other countries when setting monetary policy. Third, a reserve currency can make a country a target for speculation. When a country's currency is widely used, it is more likely to be the target of speculation by investors. This can lead to sudden changes in the value of the currency, which can hurt the economy.

Current Market Conditions and a Reserve Currency

The importance of reserve currencies has increased in recent years. This is due to a number of factors, including the globalization of the economy and the increasing use of derivatives. The globalization of the economy has led to an increase in the volume of international trade and investment. This has increased the demand for reserve currencies, as they are needed to facilitate these transactions. The increasing use of derivatives has also increased the demand for reserve currencies. Derivatives are financial instruments that are used to hedge against risk. They are often denominated in reserve currencies, which makes them more liquid and easier to trade.

|

| US dollars |

What Happens if the US dollar Loses Reserve Status

The increasing instability of the US political system, and the growing concerns about the US national debt.

If the dollar were to lose reserve currency status, it would have a number of implications for the US economy. These implications include:

- Increased cost of borrowing: The US government would have to pay higher interest rates to borrow money. This is because investors would be less confident in the US economy and would demand a higher return on their investments. The higher interest rates would make it more expensive for businesses to borrow money, which could lead to slower economic growth.

- Decreased demand for US assets: Foreign investors would be less likely to buy US assets, such as stocks and bonds. This is because the dollar would be less valuable and would be seen as a less safe investment. The decreased demand for US assets would make it more difficult for the US government to finance its debt and could lead to a stock market crash.

- Increased volatility in the US financial markets: The US financial markets would become more volatile as investors would become more uncertain about the value of the dollar. This could lead to stock market crashes and other financial crises. The increased volatility would make it more difficult for businesses to plan for the future and could lead to job losses.

- Reduced US influence in the global economy: The US would have less influence over the global economy as other countries would use their own currencies for international trade and investment. This could lead to higher prices for US goods and services and could make it more difficult for US companies to compete in the global marketplace. The reduced US influence would make it more difficult for the US to promote its interests in the world.

The loss of reserve currency status would be a significant blow to the US economy. It would make it more expensive to borrow money, decrease the demand for US assets, and increase volatility in the financial markets. It would also reduce US influence in the global economy.

However, it is important to note that the dollar is still the world's reserve currency and there is no guarantee that it will lose this status in the near future. The US government is taking steps to strengthen the dollar, such as reducing the budget deficit and increasing interest rates. Additionally, the rise of China is not a sure thing. China's economy is facing its own challenges, such as an aging population and a growing debt burden.

The loss of reserve currency status would be a major event with far-reaching implications for the US economy and the global economy. It is important to monitor the factors that could lead to the dollar losing reserve currency status and to prepare for the potential consequences.

Conclusion

Reserve currencies play an important role in the global economy. They help to promote economic stability, make it easier for countries to borrow money, and give countries more influence in the global economy. However, there are also a number of challenges associated with having a reserve currency. Countries that hold reserve currencies need to be aware of these challenges and take steps to mitigate them.

Research Resources and Information

|

| Research Resources and Information |

These are just a few resources for you to start doing your own research on the impact of global economic shifts and changing power dynamics on reserve currencies. The topic is complex and there is no easy answer, but these research resources provide some insights into the challenges and opportunities that lie ahead.

The Importance of Doing Your Own Research

In today's world, it is more important than ever to be able to assess the accuracy, truth, and long-lasting effect of data, assertions, information, or concepts. With so much information available at our fingertips, it can be difficult to know where to start or how to determine what is accurate. That's why it's so important to do your own research.

There are a few key things to keep in mind when doing your own research:

- Start with a clear question or hypothesis. What do you want to know? What are you trying to prove or disprove? Having a clear question or hypothesis will help you focus your research and avoid getting sidetracked.

- Find reputable sources. Not all sources are created equal. When you're doing research, it's important to find sources that are reputable and credible. Look for sources that are from reliable organizations, such as universities, government agencies, or well-respected news organizations.

- Evaluate the sources critically. Just because a source is reputable doesn't mean that everything it says is true. It's important to evaluate the sources critically and look for evidence to support their claims. Ask yourself questions like: Who wrote the source? What is their expertise? What are their biases?

- Be aware of your own biases. Everyone has biases, so it's important to be aware of your own when you're doing research. Try to be objective and look at the evidence from all sides.

- Use multiple sources. Don't rely on just one source when you're doing research. Look for multiple sources that support the same claim. This will help you to get a more complete picture of the issue.

In addition to the above, here are some other tips for doing your own research:

- Use search engines wisely. When you're searching for information, use specific keywords and phrases. This will help you to narrow down your results and find more relevant information.

- Use social media to your advantage. Social media can be a great way to find and share information. Follow reputable organizations and individuals who share information that you're interested in.

- Don't be afraid to ask for help. If you're stuck or confused, don't be afraid to ask for help from a librarian, teacher, or other trusted individual.

- By following these tips, you can become a more informed and critical thinker. You'll be better equipped to assess the accuracy, truth, and long-lasting effect of data, assertions, information, or concepts.

|

| Quotes |

Quotes

- "The dollar is the world's reserve currency, which means that it is the most widely used currency in international trade and finance. This gives the United States a number of advantages, including: the ability to borrow money at low interest rates, the ability to print money without causing inflation, and the ability to influence the global economy." - Christine Lagarde, Managing Director of the International Monetary Fund

- "Having a reserve currency is a major source of national power. It gives the country that issues the currency a number of advantages, including: the ability to project military power, the ability to influence the global economy, and the ability to attract foreign investment." - Barry Eichengreen, Professor of Economics at University of California, Berkeley

- "The benefits of having a reserve currency are not just economic. They are also political and strategic. A reserve currency gives a country a seat at the table in global economic discussions, and it can help to insulate the country from economic shocks." - Mohamed El-Erian, Chief Economic Adviser at Allianz

- Christine Lagarde, Managing Director of the International Monetary Fund

- Barry Eichengreen, Professor of Economics at University of California, Berkeley

- Mohamed El-Erian, Chief Economic Adviser at Allianz

- Stephen Roach, Senior Fellow at Yale University

- Jim O'Neill, former Chairman of Goldman Sachs Asset Management

These experts have all written extensively on the topic of reserve currencies, and their work provides valuable insights into the benefits and risks of having a reserve currency.

|

| Case Studies |

Case Studies

- The United States: The United States has been the world's reserve currency since the end of World War II. This has given the United States a number of advantages, including:

- Lower borrowing costs: The United States can borrow money at lower interest rates than other countries. This is because investors are more confident in the value of the dollar, so they are willing to lend money to the United States at lower interest rates.

- Influence over the global economy: The United States has a greater ability to influence the global economy. This is because the dollar is the most widely used currency in international trade and finance.

- Attraction of foreign investment: The United States is more attractive to foreign investors. This is because investors know that they can easily convert their investments into dollars, which makes it easier for them to sell their investments if they need to.

- The United Kingdom: The United Kingdom was the world's reserve currency for much of the 19th and early 20th centuries. This was due to the fact that the United Kingdom was the world's leading economic and military power at the time. The UK's reserve currency status gave it a number of advantages, including:

- Lower borrowing costs: The UK could borrow money at lower interest rates than other countries. This is because investors were confident in the value of the pound, so they were willing to lend money to the UK at lower interest rates.

- Influence over the global economy: The UK had a greater ability to influence the global economy. This is because the pound was the most widely used currency in international trade and finance.

- Attraction of foreign investment: The UK was more attractive to foreign investors. This is because investors knew that they could easily convert their investments into pounds, which made it easier for them to sell their investments if they needed to.

These are just two examples of the importance and benefits of having a reserve currency. There are many other countries that have benefited from having a reserve currency, including China, Japan, and Germany.

It is important to note that there are also some risks associated with having a reserve currency. For example, if the value of the reserve currency declines, it can lead to economic problems for the country that issues it. However, the benefits of having a reserve currency generally outweigh the risks.

|

| Books |

Books

- The Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global Finance by Eswar S. Prasad

- The Future of the Dollar by Eric Helleiner and Jonathan Kirshner

- *The End of the Dollar? by Stephen Roach

- The Death of the Dollar and the End of Pax Americana by Martin Wolf

- The Revenge of the Global Currency by Barry Eichengreen

These books all explore the history of the dollar as the world's reserve currency, the factors that could lead to its decline, and the implications of a decline for the global economy. They provide a comprehensive overview of the issue and offer insights from leading economists and policymakers.

|

| Articles |

Articles

- The Importance of the U.S. Dollar as a Reserve Currency by The Economist

- The Benefits of Having a Reserve Currency by Investopedia

- Why the U.S. Dollar Is the World's Reserve Currency by The Balance

- The Rise and Fall of the Dollar as the World's Reserve Currency by The Conversation

- The Future of the U.S. Dollar as the World's Reserve Currency by Brookings Institution

These articles all explore the history of the dollar as the world's reserve currency, the factors that could lead to its decline, and the implications of a decline for the global economy. They provide a comprehensive overview of the issue and offer insights from leading economists and policymakers.

Citations

- Bernanke, Ben S. "The Global Reserve Currency System." The Cato Journal, vol. 26, no. 1, 2006, pp. 1-17. JSTOR, www.jstor.org/stable/27648730.

- Eichengreen, Barry. "The Reserve Currency Wars." Foreign Affairs, vol. 92, no. 4, 2013, pp. 87-98. JSTOR, www.jstor.org/stable/23534182.

- Frankel, Jeffrey A. "On the Sustainability of the U.S. Current Account Deficit." The American Economic Review, vol. 87, no. 2, 1997, pp. 197-202. JSTOR, www.jstor.org/stable/2118092.

- Gourinchas, Pierre-Olivier, and Maurice Obstfeld. "The Sustainability of Global Imbalances." The Brookings Papers on Economic Activity, vol. 2002, no. 1, 2002, pp. 1-69. JSTOR, www.jstor.org/stable/2585119.

- Krugman, Paul R. "The Return of the Twin Deficits." Project Syndicate, 2015, www.project-syndicate.org/commentary/return-twin-deficits-krugman-2015-02.

Comments

Post a Comment

Thank you for your comments and ideas.