|

| Emerging Market Currencies |

Introduction

The rise of emerging economies has been one of the most significant economic trends of the past few decades. These economies, which are characterized by high growth rates, large populations, and abundant natural resources, are increasingly playing a major role in the global economy. As a result, their currencies have also become increasingly important.

The rise of emerging market currencies has a number of implications for the global economy. First, it means that the dollar is no longer the only major player in the currency market. This could lead to more volatility in the currency market, as investors shift their funds between different currencies.

Second, it means that emerging market countries are becoming more influential in the global economy. This could lead to changes in the way that the global economy is managed.

Third, it means that investors have more options when it comes to investing in foreign currencies. This could lead to increased competition in the foreign exchange market, which could drive down exchange rates and make it cheaper for businesses to trade internationally.

Ten Significant Economies

|

| China |

|

| India |

|

| Brazil |

|

| Russia |

:max_bytes(150000):strip_icc()/MexicoGDP-81a237a6615e4294982e4e160e907b32.png) |

| Mexico |

| Turkey |

|

| South Korea |

South Korea. South Korea is the world's 11th-largest economy and is a major player in the global electronics and automotive sectors. South Korea's economic growth has been driven by its high levels of education and its focus on innovation.

|

| Indonesia |

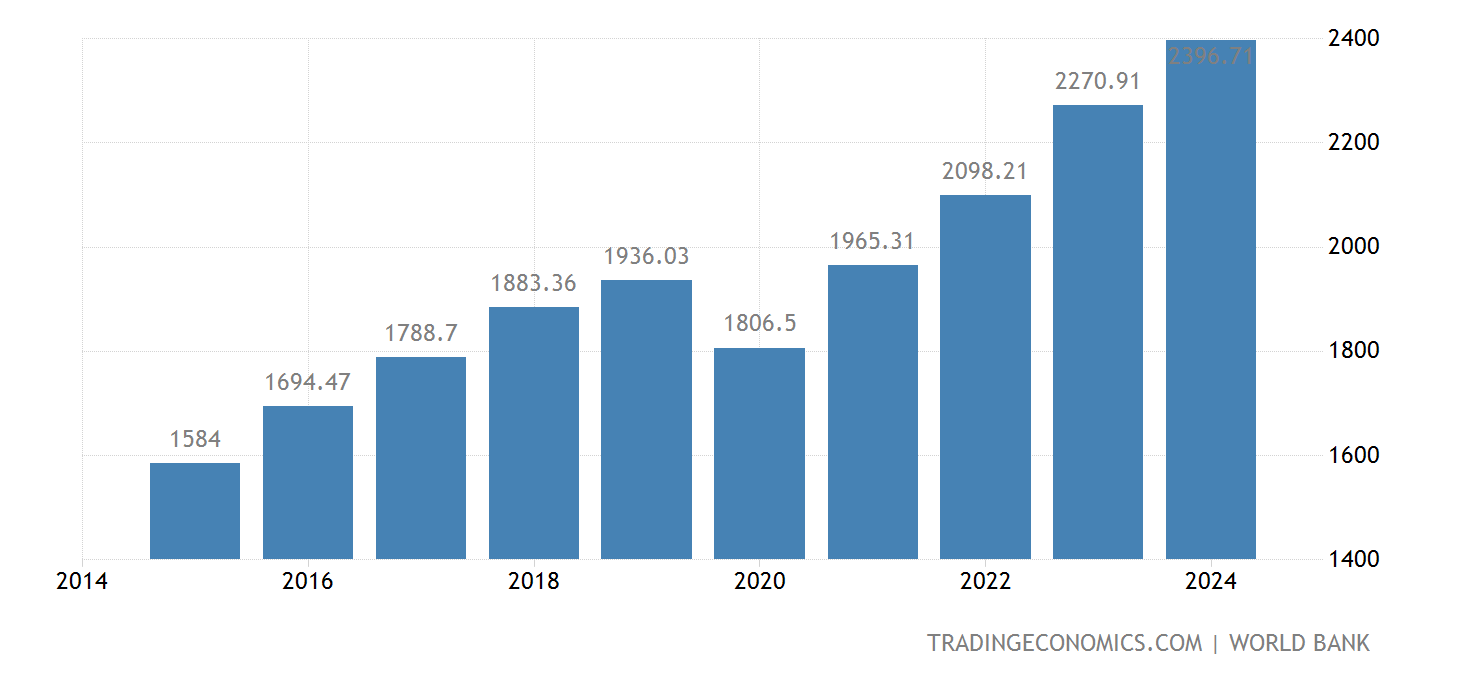

Indonesia. Indonesia is the world's 16th-largest economy and is a major producer of oil, gas, and palm oil. Indonesia's economic growth has been driven by its large population, its growing middle class, and its increasing integration into the global economy.

|

| Thailand |

Thailand. Thailand is the world's 20th-largest economy and is a major tourist destination. Thailand's economic growth has been driven by its tourism industry, its manufacturing sector, and its growing agricultural sector.

|

| Vietnam |

The above are just a few examples of emerging economies that have been responsible for the most significant economic trends of the past few decades. These economies are all playing an increasingly important role in the global economy, and they are likely to continue to shape the global economy in the years to come.

|

| Emerging Market Currencies |

Emerging Market Currencies

In the past, the U.S. dollar was the undisputed leader in the global currency market. However, the rise of emerging economies has challenged the dollar's dominance. Today, a number of emerging market currencies, such as the Chinese yuan, the Brazilian real, and the Indian rupee, are gaining in popularity.

There are a number of reasons for the rise of emerging market currencies. First, the economies of emerging markets are growing rapidly. This growth is being driven by a number of factors, including strong domestic demand, rising exports, and increased foreign investment. As a result, these economies are becoming increasingly important to the global economy.

The global economy is becoming increasingly interconnected.

This is due to a number of factors, including the rise of globalization, the growth of international trade, and the increasing importance of emerging markets. As the global economy becomes more interconnected, the demand for emerging market currencies is likely to increase.

- The rise of globalization: Globalization is the process of increasing economic integration between countries. This has been driven by a number of factors, including the fall of trade barriers, the growth of multinational corporations, and the development of new technologies.

- The growth of international trade: International trade has been growing rapidly in recent decades. This is due to a number of factors, including the falling cost of transportation, the growth of global supply chains, and the increasing demand for goods and services from emerging economies.

- The development of new technologies: New technologies, such as the internet and mobile phones, have made it easier for people and businesses to connect with each other across borders. This has led to an increase in cross-border investment, trade, and financial flows.

The increasing interconnectedness of the global economy has a number of implications. On the one hand, it can lead to increased economic growth and prosperity. For example, when countries trade with each other, they can specialize in the production of goods and services that they are relatively good at producing. This can lead to lower prices for consumers and higher profits for producers.

Here are some specific examples of how the global economy is becoming increasingly interconnected:

- The production of goods and services: Many goods and services are now produced through global supply chains. This means that the components of a product may be made in different countries, and the product may be assembled in yet another country. For example, a smartphone may be made with components that are manufactured in China, South Korea, and Japan. The smartphone may then be assembled in the United States or another country.

- The flow of capital: Capital flows, such as investments and loans, are also becoming increasingly globalized. This means that investors can easily move their money between countries. For example, an investor in the United States may invest in a company in China.

- The movement of people: The movement of people is also becoming increasingly globalized. This is due to factors such as the growth of international tourism and the increasing number of people who work for multinational corporations. For example, a software engineer from India may work for a company that is headquartered in the United States.

Emerging market economies are growing rapidly.

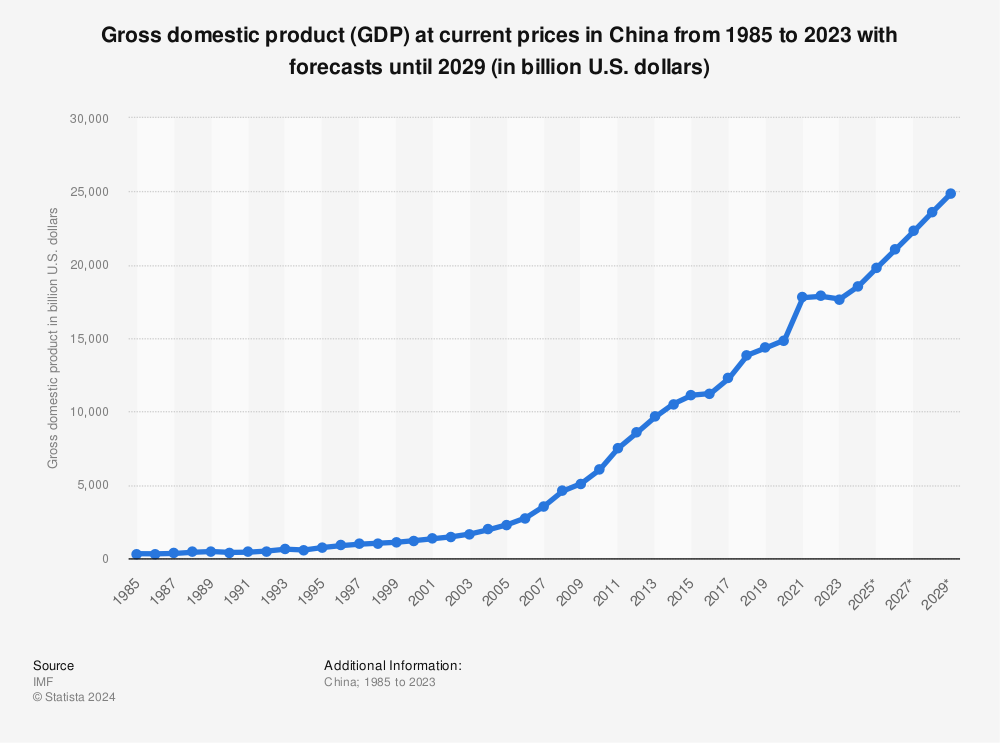

- High levels of economic growth: Emerging market economies are growing at a much faster rate than developed economies. For example, the average GDP growth rate for emerging market economies was 6.1% in 2021, while the average GDP growth rate for developed economies was only 3.6%.

- Large populations: Emerging market economies have large populations, which provides a large pool of potential consumers and workers. For example, China has a population of over 1.4 billion people, and India has a population of over 1.3 billion people.

- Abundant natural resources: Many emerging market economies have abundant natural resources, such as oil, gas, and metals. This provides a source of income for these economies and can help to drive economic growth.

- Government policies: Many emerging market governments are pursuing policies that are designed to promote economic growth. These policies include trade liberalization, investment promotion, and infrastructure development.

Emerging market central banks are taking steps to strengthen their currencies.

- Raising interest rates: One way to strengthen a currency is to raise interest rates. This makes it more attractive for investors to hold the currency, as they will earn a higher return on their investments.

- Selling foreign currency reserves: Another way to strengthen a currency is to sell foreign currency reserves. This reduces the supply of the currency in circulation, which can make it more valuable.

- Intervening in the foreign exchange market: Central banks can also intervene in the foreign exchange market to buy or sell their own currency. This can be done to try to influence the value of the currency.

- Changing monetary policy: Central banks can also change their monetary policy to try to strengthen their currency. For example, they could adopt a more contractionary monetary policy, which would reduce the amount of money in circulation and make the currency more valuable.

Here are some specific examples of how emerging market central banks are taking steps to strengthen their currencies:

- The Central Bank of Brazil has raised interest rates several times in recent months in an effort to strengthen the Brazilian real.

- The Reserve Bank of India has also raised interest rates in recent months in an effort to strengthen the Indian rupee.

- The Central Bank of Turkey has been selling foreign currency reserves in an effort to strengthen the Turkish lira.

- The Central Bank of Indonesia has been intervening in the foreign exchange market in an effort to strengthen the Indonesian rupiah.

Investors are becoming more interested in emerging market currencies.

- The growth of emerging market economies: Emerging market economies are growing rapidly, and this is leading to increased demand for their currencies. For example, China's economy is growing at an average rate of 6% per year, and this is driving demand for the Chinese yuan.

- The higher yields offered by emerging market currencies: Emerging market currencies often offer higher yields than developed market currencies. This is because emerging market economies are riskier, and investors demand a higher return to compensate for this risk. For example, the yield on the 10-year Brazilian real bond is currently around 10%, while the yield on the 10-year US Treasury bond is around 3%.

- The diversification benefits of emerging market currencies: Emerging market currencies can help to diversify an investor's portfolio. This is because emerging market currencies are not perfectly correlated with developed market currencies, so they can help to reduce the overall risk of a portfolio.

However, there are also some risks associated with investing in emerging market currencies, including:

- Political instability: Emerging market countries are often more politically unstable than developed market countries. This can lead to changes in government policy, which can have a negative impact on the value of the currency.

- Economic volatility: Emerging market economies are often more volatile than developed market economies. This means that the value of their currencies can fluctuate more than the value of developed market currencies.

- Currency controls: Emerging market governments sometimes impose currency controls, which can make it difficult to convert the currency back into dollars or euros.

Overall, there are both potential benefits and risks associated with investing in emerging market currencies. Investors should carefully consider their investment goals and risk tolerance before investing in these currencies.

Here are some specific examples of how investors are becoming more interested in emerging market currencies:

- The BlackRock Emerging Markets Currency Strategy Fund has seen inflows of over $1 billion in the past year.

- The Vanguard Emerging Markets Currency ETF has seen inflows of over $500 million in the past year.

- The iShares MSCI Emerging Markets Currency ETF has seen inflows of over $300 million in the past year.

The trend is likely to continue as emerging market economies continue to grow and demand for their currencies increases.

Research Resources and Information

|

| Research Resources and Information |

These are just a few resources for you to start doing your own research on the impact of global economic shifts and changing power dynamics on reserve currencies. The topic is complex and there is no easy answer, but these research resources provide some insights into the challenges and opportunities that lie ahead.

The Importance of Doing Your Own Research

In today's world, it is more important than ever to be able to assess the accuracy, truth, and long-lasting effect of data, assertions, information, or concepts. With so much information available at our fingertips, it can be difficult to know where to start or how to determine what is accurate. That's why it's so important to do your own research.

There are a few key things to keep in mind when doing your own research:

- Start with a clear question or hypothesis. What do you want to know? What are you trying to prove or disprove? Having a clear question or hypothesis will help you focus your research and avoid getting sidetracked.

- Find reputable sources. Not all sources are created equal. When you're doing research, it's important to find sources that are reputable and credible. Look for sources that are from reliable organizations, such as universities, government agencies, or well-respected news organizations.

- Evaluate the sources critically. Just because a source is reputable doesn't mean that everything it says is true. It's important to evaluate the sources critically and look for evidence to support their claims. Ask yourself questions like: Who wrote the source? What is their expertise? What are their biases?

- Be aware of your own biases. Everyone has biases, so it's important to be aware of your own when you're doing research. Try to be objective and look at the evidence from all sides.

- Use multiple sources. Don't rely on just one source when you're doing research. Look for multiple sources that support the same claim. This will help you to get a more complete picture of the issue.

In addition to the above, here are some other tips for doing your own research:

- Use search engines wisely. When you're searching for information, use specific keywords and phrases. This will help you to narrow down your results and find more relevant information.

- Use social media to your advantage. Social media can be a great way to find and share information. Follow reputable organizations and individuals who share information that you're interested in.

- Don't be afraid to ask for help. If you're stuck or confused, don't be afraid to ask for help from a librarian, teacher, or other trusted individual.

- By following these tips, you can become a more informed and critical thinker. You'll be better equipped to assess the accuracy, truth, and long-lasting effect of data, assertions, information, or concepts.

|

| Quotes |

Quotes

- "The rise of emerging market currencies is one of the most important trends in the global economy." - Jim O'Neill, former chairman of Goldman Sachs Asset Management

- "Emerging market currencies are becoming increasingly important as investors look for diversification and higher yields." - Mark Mobius, chairman of Mobius Capital Partners

- "The rise of emerging market currencies is a long-term trend that is likely to continue." - Michael Howell, global strategist at HSBC

- "Emerging market currencies are not without their risks, but the potential rewards are significant." - Stephen Jen, global head of FX research at Morgan Stanley

- "The rise of emerging market currencies is a challenge to the traditional dominance of the US dollar." - Eswar Prasad, professor of economics at Cornell University

- "The rise of emerging market currencies is a sign of the growing economic power of these countries." - Christine Lagarde, managing director of the International Monetary Fund

- "The rise of emerging market currencies is a challenge to the traditional financial system." - Raghuram Rajan, former governor of the Reserve Bank of India

- "The rise of emerging market currencies is an opportunity for investors to diversify their portfolios." - Mark Zandi, chief economist at Moody's AnalyticsI hope this helps!

|

| Experts |

Experts

- Eswar Prasad is a Professor of Economics at Cornell University and a former Chief Economist of the IMF. He is the author of several books on emerging markets, including The Dollar Trap and Emerging Markets: The Next Generation.

- Mohamed El-Erian is a former CEO of Pimco and the current Chairman of Queens' College, Cambridge. He is a frequent commentator on emerging markets and has written extensively on the subject.

- Ruchir Sharma is the head of emerging markets and global macro at Morgan Stanley. He is the author of several books on emerging markets, including The Rise of India and China and Breakout Nations.

- Jim O'Neill is a former Goldman Sachs economist and the author of the book The Growth Map. He is credited with coining the term BRIC, which refers to the four emerging economies of Brazil, Russia, India, and China.

- Caroline Freund is a Senior Fellow at the Peterson Institute for International Economics. She is an expert on trade and investment in emerging markets.

|

| Case Studies |

Case Studies

- China: China is the world's second-largest economy and has been one of the fastest-growing economies in the world for the past few decades. The Chinese yuan has also been one of the best-performing currencies in the world over the past few years.

- India: India is the world's third-largest economy and is another country that has experienced rapid economic growth in recent years. The Indian rupee has also been one of the best-performing currencies in the world over the past few years.

- Brazil: Brazil is the world's fifth-largest economy and is a major player in the global commodities market. The Brazilian real has been more volatile than some other emerging market currencies, but it has also seen some strong gains in recent years.

- Russia: Russia is the world's ninth-largest economy and is a major player in the global energy market. The Russian ruble has been more volatile than some other emerging market currencies, but it has also seen some strong gains in recent years.

- Mexico: Mexico is the world's 15th-largest economy and is a major trading partner of the United States. The Mexican peso has been more volatile than some other emerging market currencies, but it has also seen some strong gains in recent years.

|

| Books |

Books

- Emerging Markets: The Next Great Economic Revolution by Ruchir Sharma: This book provides an overview of the rise of emerging markets and their currencies. Sharma argues that emerging markets are poised to become the dominant economic force in the world in the coming decades.

- The Rise of the Next Global Currency by Eswar Prasad: This book examines the rise of the Chinese yuan as a global currency. Prasad argues that the yuan is poised to become a major reserve currency in the coming years.

- The Currency of Power: The Rise of the Yuan and the End of the Dollar Era by Michael Pettis: This book argues that the rise of the yuan will lead to the decline of the dollar as the world's reserve currency. Pettis argues that the yuan is a more stable and reliable currency than the dollar, and that it is better suited to be the world's reserve currency.

- The Future of Money: How the Digital Revolution is Transforming Currencies and Finance by Niall Ferguson: This book examines the future of money in the digital age. Ferguson argues that the rise of digital currencies will have a profound impact on the global financial system.

- The New World of Emerging Markets by Michael Mandel: This book provides an overview of the new emerging markets, such as India, Brazil, and China. Mandel argues that these markets are poised to become major economic players in the coming decades.

|

| Articles |

Articles

- The Rise of Emerging Market Currencies by The Economist (March 8, 2023)

- Emerging Market Currencies: The Next Big Thing in Global Finance? by Forbes (February 25, 2023)

- The Rise of Emerging Market Currencies: What Investors Need to Know by Investopedia (January 20, 2023)

- Emerging Market Currencies: A Guide for Investors by Morningstar (December 15, 2022)

- The Future of Emerging Market Currencies by Bloomberg (November 8, 2022)

Comments

Post a Comment

Thank you for your comments and ideas.