|

| Economic Shifts and Changing Power Dynamics |

Introduction

The global economic landscape is constantly shifting, and this has a significant impact on the reserve currencies that are used by countries around the world. In recent years, we have seen a number of global economic shifts that have the potential to change the landscape of reserve currencies.

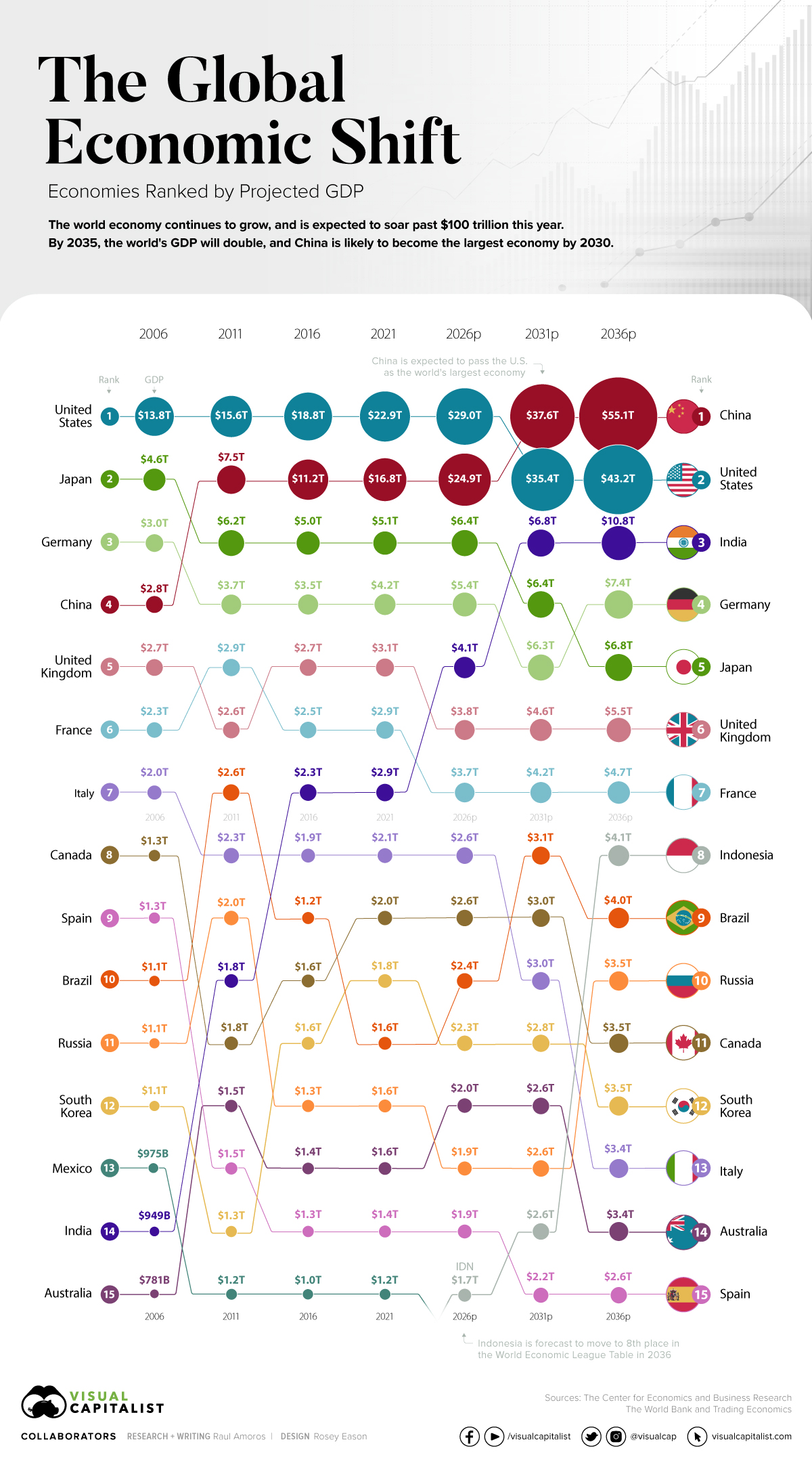

One of the most significant shifts has been the rise of China as a global economic power. China's economy is now the second largest in the world, and it is growing at a rapid pace. This has led to increased demand for the Chinese renminbi (RMB) as a reserve currency. In 2016, the RMB became the world's fifth most traded currency, and it is expected to continue to grow in importance in the years to come.

Another important shift has been the decline of the US dollar as a reserve currency. The US dollar has been the world's reserve currency for over a century, but its dominance has been waning in recent years. This is due to a number of factors, including the US's large budget deficits, its growing national debt, and the perception that the US government is not as stable as it once was.

|

| Economic Shifts and Changing Power Dynamics |

The rise of China and the decline of the US dollar have led to a more multipolar world economy. This means that there is no single dominant reserve currency, and that countries have more options when it comes to choosing which currency to hold as reserves. This could lead to a more stable and resilient global financial system, as countries will be less reliant on a single currency.

However, there are also some potential risks associated with a more multipolar reserve currency system. For example, it could lead to increased volatility in the foreign exchange market, as countries compete for market share. It could also make it more difficult for countries to manage their monetary policy, as they will be more exposed to the whims of other countries' central banks.

Overall, the impact of global economic shifts and changing power dynamics on reserve currencies is complex and uncertain. There are both potential benefits and risks associated with a more multipolar reserve currency system. It is too early to say what the long-term impact will be, but it is a trend that is worth watching closely.

In addition to the rise of China and the decline of the US dollar, there are a number of other factors that could impact the future of reserve currencies. These include:

- The increasing interconnectedness of the global economy

- The growing importance of emerging markets

- The development of new financial technologies

It is difficult to predict how these factors will play out in the years to come, but it is clear that the landscape of reserve currencies is changing. The reserve currency system that we know today may not be the same in the future.

Research Resources and Information

|

| Research Resources and Information |

The Importance of Doing Your Own Research

In today's world, it is more important than ever to be able to assess the accuracy, truth, and long-lasting effect of data, assertions, information, or concepts. With so much information available at our fingertips, it can be difficult to know where to start or how to determine what is accurate. That's why it's so important to do your own research.

There are a few key things to keep in mind when doing your own research:

- Start with a clear question or hypothesis. What do you want to know? What are you trying to prove or disprove? Having a clear question or hypothesis will help you focus your research and avoid getting sidetracked.

- Find reputable sources. Not all sources are created equal. When you're doing research, it's important to find sources that are reputable and credible. Look for sources that are from reliable organizations, such as universities, government agencies, or well-respected news organizations.

- Evaluate the sources critically. Just because a source is reputable doesn't mean that everything it says is true. It's important to evaluate the sources critically and look for evidence to support their claims. Ask yourself questions like: Who wrote the source? What is their expertise? What are their biases?

- Be aware of your own biases. Everyone has biases, so it's important to be aware of your own when you're doing research. Try to be objective and look at the evidence from all sides.

- Use multiple sources. Don't rely on just one source when you're doing research. Look for multiple sources that support the same claim. This will help you to get a more complete picture of the issue.

Doing your own research can be time-consuming, but it's worth it. By following these tips, you can increase your chances of finding accurate and truthful information.

In addition to the above, here are some other tips for doing your own research:

- Use search engines wisely. When you're searching for information, use specific keywords and phrases. This will help you to narrow down your results and find more relevant information.

- Use social media to your advantage. Social media can be a great way to find and share information. Follow reputable organizations and individuals who share information that you're interested in.

- Don't be afraid to ask for help. If you're stuck or confused, don't be afraid to ask for help from a librarian, teacher, or other trusted individual.

By following these tips, you can become a more informed and critical thinker. You'll be better equipped to assess the accuracy, truth, and long-lasting effect of data, assertions, information, or concepts

|

| Quotes |

- "The rise of China and the decline of the US dollar are two of the most significant shifts in the global economy in recent years. These shifts have had a major impact on the reserve currency system, and they are likely to continue to do so in the years to come." - Christine Lagarde, Managing Director of the International Monetary Fund

- "The global economy is becoming more multipolar, and this is having a significant impact on the reserve currency system. There is no longer a single dominant reserve currency, and countries have more options when it comes to choosing which currency to hold as reserves." - Eswar Prasad, Professor of Economics at Cornell University

- "The rise of new economic powers, such as China, is challenging the traditional dominance of the US dollar as the world's reserve currency. This could lead to a more multipolar reserve currency system, which would have implications for the global financial system." - Barry Eichengreen, Professor of Economics at the University of California, Berkeley

- "The changing power dynamics in the world are having a significant impact on the reserve currency system. The US dollar is no longer the only game in town, and countries are increasingly looking to other currencies, such as the euro and the renminbi, as reserve assets." - C. Fred Bergsten, Founding Director of the Peterson Institute for International Economics

- "The future of the reserve currency system is uncertain, but it is clear that the global economic landscape is changing. The reserve currency system that we know today may not be the same in the years to come." - Adam Tooze, Professor of History at Columbia University.

|

| Experts |

Expertise

- Christine Lagarde, Managing Director of the International Monetary Fund

- Eswar Prasad, Professor of Economics at Cornell University

- Barry Eichengreen, Professor of Economics at the University of California, Berkeley

- C. Fred Bergsten, Founding Director of the Peterson Institute for International Economics

- Adam Tooze, Professor of History at Columbia University

- Homi Kharas, Senior Fellow and Director of the Global Economy and Development Program at the Brookings Institution

- Nouriel Roubini, Professor of Economics at New York University's Stern School of Business

- Stephen Roach, Senior Fellow at the Jackson Hole Group and former chief economist of Morgan Stanley

|

| Case Studies |

Case Studies

- "The Future of the Reserve Currency System: An Empirical Analysis" by Eswar Prasad (2015)

- "The Rise of the BRICS and the Future of the International Monetary System" by Barry Eichengreen and C. Fred Bergsten (2012)

- "The Renminbi as a Global Currency: A Status Report" by the Peterson Institute for International Economics (2017)

- "The Euro as a Reserve Currency: Past, Present, and Future" by Charles Wyplosz (2018)

- "The Multipolar Reserve Currency System: A New Paradigm for Global Finance" by Homi Kharas (2019)

|

| Books |

Books

- The Future of the Reserve Currency System: An Empirical Analysis by Eswar Prasad (2015)

- The Rise of the BRICS and the Future of the International Monetary System by Barry Eichengreen and C. Fred Bergsten (2012)

- The Renminbi as a Global Currency: A Status Report by the Peterson Institute for International Economics (2017)

- The Euro as a Reserve Currency: Past, Present, and Future by Charles Wyplosz (2018)

- The Multipolar Reserve Currency System: A New Paradigm for Global Finance by Homi Kharas (2019)

- The End of the Dollar: The Unmaking of America’s World Order by Benn Steil (2018)

- The Power of Currency: How Money Shaped the Modern World by Adam Tooze (2018)

- The New World Order: How the United States Can Survive the Rise of China by Ian Bremmer (2019)

- The Death of Money: The Coming Collapse of the Global Financial System and How to Save Yourself by James Rickards (2014)

|

| Articles |

Articles

- "The Future of the Reserve Currency System" by Eswar Prasad (Project Syndicate, 2015)

- "The Rise of China and the Future of the Dollar" by Barry Eichengreen (Project Syndicate, 2014)

- "The Renminbi as a Global Currency: Progress and Challenges" by Charles Wyplosz (Brookings Institution, 2018)

- "The Multipolar Reserve Currency System: A New Paradigm for Global Finance" by Homi Kharas (Brookings Institution, 2019)

- "The End of the Dollar: The Unmaking of America’s World Order" by Benn Steil (Foreign Affairs, 2018)

- "The Power of Currency: How Money Shaped the Modern World" by Adam Tooze (The Atlantic, 2018)

- "The New World Order: How the United States Can Survive the Rise of China" by Ian Bremmer (Foreign Affairs, 2019)

- "The Death of Money: The Coming Collapse of the Global Financial System and How to Save Yourself" by James Rickards (The Daily Beast, 2014)

Comments

Post a Comment

Thank you for your comments and ideas.